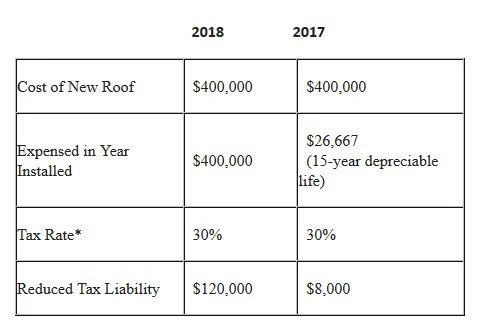

The IRS Section 179 tax reform bill created a tax benefit for owners of commercial buildings: You may now expense a replacement roof for up to $1,220,000 in the year you replace it!

What This Could Mean for Upson Company’s Roofing Projects:

After researching 2024’s IRS Section 179 Depreciation Rules, here are some highlights on how these sweeping changes are relevant to planning your roof replacement. (You may also want to watch the short video on the right side of this page for an overview).

Building owners are now able to expense up to $1,220,000 of the cost of qualified improvements to real property placed in service during the taxable year.

To qualify for the Section 179 Deduction, the roof must be purchased or financed and placed in service between January 1, 2024, and December 31, 2024.

Roof replacements are now included in the definition of qualified real property improvements

Based on these tax changes, this year may be an excellent time to replace your roof and reduce your tax liability by 100%.

For Idaho businesses, an incentive of $0.05 per ft2 of roof area is available for retrofits and new construction through Idaho Power’s Commercial and Industrial Energy Efficiency Program, when applied to the roof above a space with mechanical air conditioning.